The Difference Between Paying Cash For Products And Services Instead Of Using Credit Card?

Cash used to be king. People paid for everyday purchases with greenbacks or with checks (which are functionally equivalent to cash), and they saved credit cards for big, exceptional purchases — If they had credit cards at all. Nowadays, credit cards are accepted almost everywhere, and some people never carry cash at all.

-

Credit cards are safer to carry than cash and offer stronger fraud protections than debit.

-

You tin can earn significant rewards without changing your spending habits.

-

It's easier to track your spending .

-

Responsible credit card apply is one of the easiest and fastest ways to build credit .

Using credit cards does non mean going into debt . Spend coin every bit you normally would, pay your balance in full every month, and you'll reap all the benefits of credit cards while never carrying debt or paying a penny in involvement.

Can I put that on my card?

Detect out if it's possible (or wise) to use credit for housing, car payments, student loans and more than.

Credit cards are safer to carry and employ

If y'all lose your wallet or get robbed, any greenbacks you were carrying is almost certainly gone forever. If thieves proceed a spending spree with your credit cards, however, you more often than not won't be held responsible for fraudulent purchases. It may accept some time to sort out the resulting mess, merely yous won't lose whatever of your money.

Debit cards, too, pose a risk. When your credit bill of fare is used fraudulently, it's the card issuer that loses money. When your debit card is used fraudulently, the money comes out of your bank account . Assuming you report the fraud promptly, you lot should go your money back — somewhen. It could exist a while until things are sorted out. During that time, checks may bounciness, automatic payments may be refused due to insufficient funds, and you may accept a hard time covering your bills.

Credit cards earn like shooting fish in a barrel rewards

Credit carte du jour rewards exist to encourage you to use your credit card, and they're very persuasive indeed. With a simple flat-rate menu that pays the same amount on every purchase, you lot tin can get back 1.5% or even 2% of every dollar y'all spend, either as greenbacks or every bit points or miles to redeem for travel or other things. Spend $i,000 a month, and you could earn $180 to $240 a year without any special effort.

Other cards pay college rewards in specific spending categories, such every bit groceries, gas or restaurants. Combine a handful of cards, and you lot can amplify your rewards considerably.

| Spending | Rewards rate | Annual rewards | |

|---|---|---|---|

| Groceries | $400 / month | 6% | $288 |

| Restaurants | $150 / calendar month | • five% for 3 months • three% for 9 months | $81 |

| Gas | $100 / month | • 5% for 6 months • three% for six months | $48 |

| Amazon.com | $100 / month | • five% for six months • 2% for six months | $42 |

| Streaming media | $fifty / month | 6% | $36 |

| Travel | $1,000 / year | 5% | $fifty |

| Everything else | $1,000 / month | 2% | $240 |

| Total | $785 |

Come across how the rewards are earned

Groceries

-

The Blue Cash Preferred® Menu from American Express earns 6% cash dorsum on upwards to $6,000 a year in spending at U.South. supermarkets, then one% (terms apply — see rates and fees ).

Restaurants

-

For three months: The Discover information technology® Cash Back earns v% cash back on up to $one,500 per quarter in spending in categories that you lot activate, and i% on other purchases. In 2020, restaurants was a 5% category for one quarter.

-

For nine months: The Chase Liberty Flex℠ earns iii% cash back at restaurants.

Gas

-

For 3 months: The Chase Liberty Flex℠ earns five% cash back on up to $1,500 in spending in quarterly categories that you activate. In 2020, Chase had gas stations every bit a v% category for three months.

-

For three months: In 2020, the Discover it® Greenbacks Dorsum had gas stations as a 5% category for three months.

-

For six months: The Bluish Greenbacks Preferred® Card from American Express earns 3% greenbacks back at U.Due south. gas stations (terms use).

Amazon.com

-

For six months: In 2020, Hunt and Discover had Amazon.com every bit a 5% category for three months apiece.

-

For vi months: The Citi® Double Cash Carte du jour – 18 month BT offer earns 2% greenbacks dorsum on all purchases — 1% when you buy and 1% when y'all pay it off.

Streaming media

-

The Blue Cash Preferred® Carte from American Express earns vi% cash dorsum on select U.S, streaming subscriptions (terms utilize).

Travel

-

The Chase Freedom Flex℠ earns 5% greenbacks back on travel booked through Chase.

Everything else

-

Use the Citi® Double Cash Card – 18 calendar month BT offering and earn 2% cash dorsum.

A word of caution, however: Don't spend more than you normally would simply to get additional rewards. A picayune cash back won't make up for that extra $100 at the grocery store or that extra $250 worth of wearing apparel. And if you behave a remainder from calendar month to month, the interest you pay tin more eat upwards the value of your rewards, and so pay in full whenever possible.

Credit cards help y'all runway spending

Keeping tabs on your upkeep can be a challenge no thing how you spend your money. But figuring out where cash went is especially difficult. Misplace a receipt, and in that location's often no other record of how much you spent and where you spent it. Checks? Forget to enter 1 in your check register, and you'll need to expect for the recipient to greenbacks it before you can track it (and some people are notorious for holding on to checks for months).

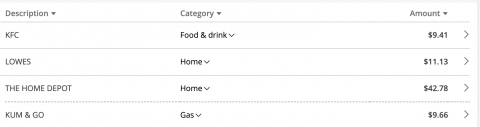

With credit cards, everything shows up on your account online in close to real time. Further, many issuers automatically categorize purchases according to the merchant:

Purchases on a Hunt credit menu identified by categories.

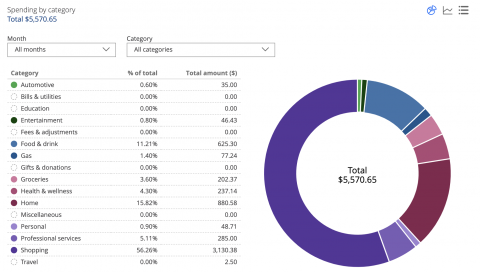

Near major issuers as well let you generate reports to see how much you've spent in dissimilar categories in a given month, or for the yr to appointment, or for a period you lot specify:

Spending report on a Chase credit card.

If yous use a budgeting app like Mint or You Demand a Budget, yous can import data from your credit card and depository financial institution accounts. This makes it easy to fit each buy into a budget category and see where you're overspending and where you can stand to splurge a trivial.

Credit cards help build credit

You don't demand to have a credit carte du jour to have good credit, and you certainly don't have to behave a balance. Just careful use of a credit carte is the single best way to improve your credit scores, and good credit opens many doors. Information technology makes it easier to find housing, whether a potential landlord is checking your credit before giving you the keys or you're applying for a mortgage to buy a home. Cell phone providers, insurance agents and utility companies as well might employ your credit history to determine your eligibility and even your rates. It can even boost your chances of landing a job, as many employers run credit checks on task applicants.

If you do have a credit card, making regular small-scale purchases, keeping your balances depression and paying your bills on time will amend your credit score over time.

When not to use a credit card

When you'll have to pay an extra fee: Merchants pay processing fees every fourth dimension you utilize a credit carte du jour. Most of the time, those fees are rolled into the merchant's prices, like whatsoever other cost of doing business. But sometimes a merchant might pass the processing price to y'all directly by tacking on an upfront surcharge or "convenience fee" for using your credit card. In those cases, you'll probably desire to pay some other style, unless your credit carte rewards are high enough that they'd cancel out the surcharge.

When you don't desire the merchant to pay a fee: Similarly, you may want to avoid using credit cards with smaller merchants yous especially want to support. They may appreciate it if you lot pay in cash or by check, considering then they don't have to pay the processing fees. Fifty-fifty debit cards are better than credit cards from merchants' standpoint, considering processing fees for debit cards tend to be lower than what they'd pay for a credit menu transaction.

When y'all don't want to overspend: Some people have a hard time keeping their spending under control when they employ a credit menu. That five-figure credit card limit might brand it difficult to remember why you shouldn't buy that shiny object. If yous're shut to your credit limit or you're worried about racking up a high credit carte du jour residue, you may desire to attain for your debit carte or use greenbacks.

At that place are a lot of dandy benefits for credit carte users. Practice your enquiry to find the best credit carte for you. Just brand sure you're able to spend wisely, whatever method of payment yous choose.

To view rates and fees of the Blue Cash Preferred® Card from American Express , run across this folio .

The Difference Between Paying Cash For Products And Services Instead Of Using Credit Card?,

Source: https://www.nerdwallet.com/article/credit-cards/why-every-purchase-should-be-on-a-credit-card

Posted by: robertstans1957.blogspot.com

0 Response to "The Difference Between Paying Cash For Products And Services Instead Of Using Credit Card?"

Post a Comment